Everybody is talking about Bitcoin. It’s in the news. It’s in the papers. It’s gone from $1 several years ago to almost $20,000 in recent times. You can’t hide from it. In Singapore, where I live, there’s news about how people rushing to buy Bitcoin have crashed a couple of Bitcoin ATMs.

I finally got off my butt to go find out more about it, since a friend asked me for advice about whether to get into it. I did a lot of reading, and found three camps of voices – (1) the crypto-proponents who say that Bitcoin will change the world of finance. These usually come from people selling Bitcoin, which should put you on alert immediately. (2) the establishment voices who say that Bitcoin is at worst a ponzi scam, and at best a bubble that will soon burst. And (3) the vast majority of people who don’t understand it enough to even form an opinion, or are unwilling to give advice about it.

Here’s the thing, people from camp 1 and camp 2 routinely accuse each other of having an agenda and being biased in their opinions. And BOTH are right – BOTH sides have something they are trying to push or protect, so take both views with a pinch of salt. Try to understand the underlying arguments or technology and form your own view, but look at things holistically. Everything looks different when examined in isolation and cut off from external factors, but the world doesn’t work like that.

DISCLAIMER

Let me first state some disclaimers.

(a) I don’t own any Bitcoins, at all, and am in no way involved in the trade or mining of Bitcoin.

(b) I don’t have any investments, in stocks or shares, at all.

(c) I have no vested interest in any financial system or institution.

If you think any or all of these above disqualifies me from making any valid points, by all means, stop reading here. But if you think that an “outsider” can still form a useful opinion based on researching and understanding the issues, read on.

MY VIEW

I’ve come to the conclusion that Bitcoin itself is not a bad thing. It’s a very interesting solution to a lot of problems in the existing system. Bitcoin is a form of cryptocurrency, and for a very simplistic explanation of how it works, read this. If you’re up for something heavier and more technical, the founder of Bitcoin released a Bitcoin White Paper which is pretty interesting, too.

Having said that, I have to state that in my opinion, at the moment, Bitcoin is highly overpriced and poised for a crash, which echoes the sentiments of many people who have studied this issue, even those who made a lot of money already from Bitcoin. So if you already own Bitcoin, great, do what you want with it, or even better, cash out now and use the money on something more tangible like a nice house in France. If you don’t already own Bitcoin and want to shell out upwards of US$17,000 on a Bitcoin now, my advice to you is: please don’t. Here are 10 reasons why I think buying Bitcoin at this point in time is dangerous:

- All the classic signs of an asset bubble are there. – sudden and unexplained price spike (Bitcoin has been around since before 2010, but it suddenly spiked in mid-2017), insane levels of price growth, people rushing to get into the market, people spending beyond their means to try to get into Bitcoin, people buying without understanding what it is. In every previous bubble, people were convinced that they would get rich, or at least make a huge profit and get out before the bubble burst. It doesn’t work that way. Nobody knows when a bubble will burst, unless you are the ones manipulating it in the first place (see point #3 below), and when it bursts, it crashes very quickly, like the housing bubble. Losing money is guaranteed for most people, and Bitcoin is shaping up to be exactly like that.

- You won’t be able to get rich like the people who say they have already become rich on Bitcoin. You’ll never be able to be like the people who said they’ve already made a lot of money on it – these people bought Bitcoin when it was low. You will be buying Bitcoin when it is insanely high. For example, someone who bought Bitcoin at $100, or even $1000, will still be making a handsome profit if Bitcoin crashes by 80% from its current price of well over $16,000. They are not wrong when they say that they aren’t worried about losing money even if the price drops from it’s current levels. You, on the other hand, if you buy now at $17,000 dollars per bitcoin, will lose $13,000 if the prices crash like that.I’m not saying it will crash, it might, it might not. I’m saying stop listening to people who say they made a lot of money. If you didn’t buy at the price they bought it at, you’ll never be like them, so forget it. There are many people who are joining the Bitcoin craze knowingthat the market is in for a steep correction eventually. They hope to be able to ride the dragon for as long as possible, and get out when it looks like the end. The problem with this thinking, as with all previous bubbles, is that nobody knows when that will happen, and when it happens, it happens too quickly for most to react. So the risk is very high at this point in the Bitcoin market.

- Those who made Bitcoin version 1 can easily make Bitcoin version 2, while cashing out on Bitcoin v1 and getting filthy rich at the same time. Bitcoin is shrouded in mystery. Who invented it and who holds the coins today is largely unknown to most people. It is an undisputed fact that criminals and criminal organisations have been and are still using Bitcoin as a way to transact under the radar. Money laundering is rampant in the Bitcoin world. Ask yourself – why would criminal organisations want Bitcoin to go mainstream and attract government attention and scrutiny and even regulation? Answer – they don’t. If they were somehow involved in the creation and early adoption of Bitcoin, they can and probably have already created another new cryptocurrency to switch to once Bitcoin becomes too “hot”. At that point, they will dump Bitcoins in large amounts, cash out, become filthy rich, and switch to the new cryptocurrency which they have created and also control, and leave worthless Bitcoins in the hands of the people who paid a lot for them. It’s a very real possibility, and should not be dismissed out of hand.

- Bitcoin is not “digital gold”. There are many who claim that Bitcoin is just like gold, only digital. The fact that it is finite is the reason why the value keeps going up – that the scarcity is driving demand. There are indeed many similarities between Bitcoin and gold – in fact, it is more like gold than it is like a true currency, especially at US$20,000 a coin. I won’t go into the reasons why it is similar to gold – you’ll find that all over the internet from people who are trying to get you to buy into Bitcoin.

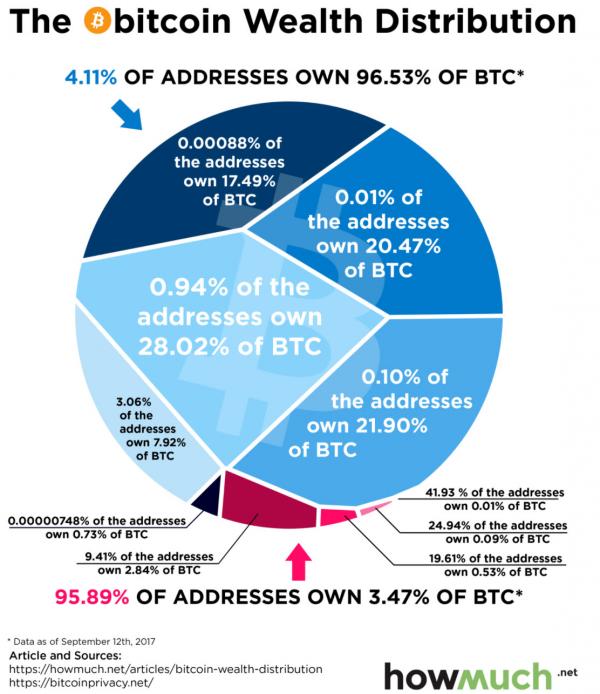

Here’s the single most important reason why it is NOT like gold – gold is a physical commodity on earth, sitting near the top of the list of all physical commodities in value because of various reasons. You can’t (not right now anyway) make more gold, and you can’t easily make other commodities more valuable to replace gold. Bitcoin is completely not like that. It is a digital creation, a virtual commodity, a product of mathematical and computational effort. Other types of cryptocurrency can and will be invented which will directly compete with Bitcoin. Russia and many countries and institutions are already developing their own. This is the digital equivalent of creating new types of gold, rendering the “old” gold less scarce and therefore less valuable.In the real world, you can’t have people say, “right, we’re all gonna ditch gold and switch to trading clay. All you suckers holding gold, haha bye bye, we’re going to get rich because we all decided tomorrow that gold is worthless and clay is valuable.” It doesn’t work like that in the real world. But in cryptocurrencies, that’s exactly what can and is going to happen. 4% of Bitcoin addresses control 95% of the market, and 1% controls HALF of the entire Bitcoin market. That is an incredibly small group controlling a very large share of the market. And nobody knows who they are. When they decide to cash out, which they will, they will wreck the price of Bitcoin and move to a new cryptocurrency (see the previous point about Bitcoin V1 and Bitcoin V2) and be exactly where they are currently in terms of holdings, but billions of dollars richer in the meantime. And all the remaining Bitcoin owners, who collectively hold less than 5% of the bitcoins now, will be awash in millions of worthless Bitcoins.

- Arguments about Bitcoin and cryptocurrency in general have been conflated. You need to separate the two. Bitcoin is a type of currency built on block-chain technology, which itself is a subset of the general term cryptocurrency. The broad consensus is that cryptocurrency is going to be the currency of the future, maybe even the global currency. But that’s not the same as saying Bitcoin will keep rising in price because of this. People use the two terms interchangeably, when they should not. It’s like saying the word “bread”, which is a subset of staple foods, which is a subset of food in general, can be used interchangeably with the word “food”. It can’t and shouldn’t. You can’t argue that the price of bread will rise forever because people will always need food. Once bread becomes too expensive, people will switch to other food.Likewise, when Bitcoin becomes too expensive or hard to get into, other cryptocurrencies and other block-chain currencies will rise in popularity (and there are already many others out there). When enough arise and are adopted widely, Bitcoin will be relegated to just one of the many options out there and the price will drop to a more realistic number. At that point, people who bought it at less than $1000 will still make a lot of money; people who bought it at $20,000 will lose a lot of money. If you buy Bitcoin now, you belong to the latter category.

- Bitcoin is not as secure as people think it is. Bitcoin is prized mostly because, as a cryptocurrency, it is secure. This is not entirely true – Bitcoin exchanges have been hacked before. And even the security of the mathematical function itself, supposedly difficult to crack, is under threat, due to the development of quantum computing. So potentially the most valuable attribute of Bitcoin will vanish in a few years, once computing power takes a huge leap forward. And when that happens, it’s value will drop drastically, or at the very least stop appreciating. Of course, people will say that by that time, we can switch to a new cryptocurrency using an even more complex formula, which will be secure by quantum computing standards. But that’s exactly my point – Bitcoin itself, in its current form, will be obsolete at that time and worth much less than at current prices.

- The bullish sentiment of the Bitcoin market ignores the effect of major institutional intervention. Right now, Bitcoin is too small to be a threat to global banking systems. So most governments are not devoting significant resources to look into it. But as it grows, it will attract such attention and political will to do something. There’s a good reason why governments want their own currencies, to have control over fiscal policy and sovereignty. Look at Brexit and the move towards independence within regions in many countries.

Bitcoin is touted as the way for people to escape the control of central banks and governments. Don’t think that central banks and governments will sit idly while it happens. When it grows big enough, and such a time is very near, you’ll see a backlash from the existing financial systems and governments. They will either ban bitcoin, like China has, or they will start their own cryptocurrency, which Russia is doing. People say that China’s ban on bitcoin has not affected the market. It has, and it did, even though it was temporary. When many more countries ban Bitcoin and/or introduce their own cryptocurrency alternatives, you will see cryptocurrencies in general rise in adoption, but Bitcoin itself will suffer in price, because then there will be so many alternatives to choose from. Remember, we are talking about whether you should buy Bitcoin now at almost $20,000 a coin. We aren’t talking about whether you should bet on cryptocurrencies in general. - The shutdown of Bitcoin, a difficult, if not impossible, task for governments, is not the only threat to Bitcoin’s value. A related issue is when crypto proponents push the argument that because of the way Bitcoin is designed, no government can shut it down. That’s probably true. But what they aren’t telling you is that governments can bring down the price of Bitcoin by supporting an even more attractive option for people. Let’s say someone invents another type of cryptocurrency, which I stress, is not too difficult to do, as shown by the number of alternatives already coming out now. If, say, China decides to back this currency, it can immediately mandate that every shop in China has not only got to accept this currency, it must trade in that currency. And you better believe China is capable of enforcing such an action. What will happen is that suddenly, you have a Bitcoin alternative available that is being actively used in the largest consumer market in the world. You will see a lot of people try to get into that instead, some will even dump Bitcoins to cross over, which naturally will drive the price of Bitcoin down. It won’t shut Bitcoin down, but it will cause Bitcoin to lose a lot of value, which is again the point I’m trying to make – unlimited growth for Bitcoin is not sustainable. This is just one of many scenarios that can and will take place, so don’t believe the hype that Bitcoin is untouchable.

- Bitcoin is not viable anymore as currency. It is a commodity that is traded directly between individuals. It is not a currency because it cannot be used in most places in the world at the moment, and ironically, its recent volatility is increasingly preventing it from being used as currency, coupled with rising transaction fees. Some merchants which used to accept bitcoin have stopped doing so, because the rising price means that they actually have to refund money to customers while transactions are ongoing, because the bitcoins are now worth more than the item they are buying. It sounds great for customers, but it’s not. If you are thinking of buying into bitcoin because it is the future of currency, it’s the opposite. Your demand for a limited commodity (Bitcoin, not cryptocurrencies in general) is driving the price up to where it is useless as a currency. But people who want the price high so they can cash out don’t want you to know that, so they keep pushing this “currency” nonsense. I repeat, Bitcoin was ironically half decent as a form of currency before 2017, when it had a relatively stable value. It is now way too volatile to be anything but an asset bubble, so stop thinking of it as a currency. Nobody is buying it now for the purpose of using it as a currency, and even Bitcoin sellers are admitting that the direction it is heading is further and further from wide adoption as a currency.In fact, Bitcoin in its current form can’t eventually be the world currency, as in, it can’t handle all global transactions at once, due to technical reasons like block size limitations and so on which I won’t go into here. At best, Bitcoin is the precursor to another future cryptocurrency that does become usable as a global currency, but that simply reinforces the point that buying Bitcoin now thinking it will become the future world currency is misguided.

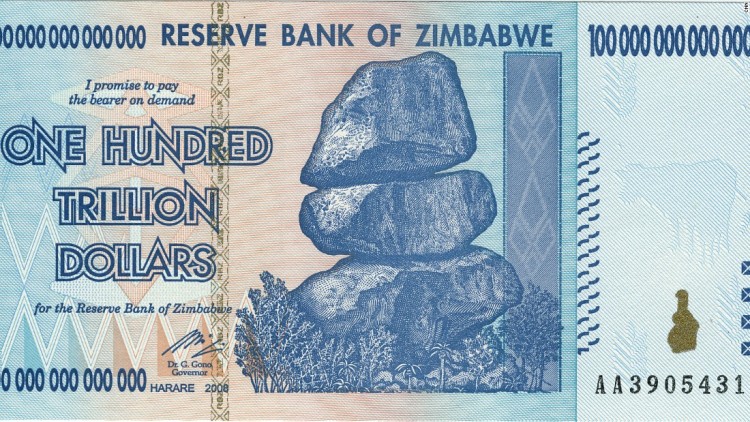

- Bitcoin is virtual, but the ultimate things of value remain physical. People who say that Bitcoin is unlike the tulip craze or the housing market bubble, are partially right but also wrong. They are right in saying that this is something different, a completely new asset class, or even a new way to do business. However, Bitcoin isn’t as delinked from the real world as it sounds. People don’t own Bitcoin for the sake of Bitcoin. Bitcoin is nothing more than a string of mathematical code. It is valuable only because people think someone will come along and pay more for it in the future. The second the sentiment turns, as it does when a bubble bursts, people panic and start to sell. This is because Bitcoin, like money, is a means to an end.Money itself is worthless, it’s just paper. It only has value because you hope somebody will give you something valuable in exchange for it. Without that, the paper itself is essentially of no value. In many cases in the past, money has been rendered worthless for a number of reasons, like hyperinflation. Even the current quantitative easing is a form of printing new money, making it worth less.

In money laundering, the final step is the most important – when you turn the illicit funds into wealth that seems legitimate. This is called integration, and frequently involves converting the cash into tangible physical assets like property, investments, and gold. People can live in castles and drive fast cars, they can enjoy good wine and dress in expensive jewelry, but they can’t doing anything with a Bitcoin, except hope that somebody will pay them real money for it eventually. If that doesn’t happen, the Bitcoin is essentially worth nothing, just like some paper currencies of the past. So a Bitcoin bubble is real and not unlike previous bubbles – Bitcoin is only worth what people think it is worth, and has no other intrinsic value. Which is why the argument that Bitcoin will forever hold its value is flawed, and will likely be proved false when the people controlling the vast majority of Bitcoin decide to cash out and convert their wealth into real-world assets, leaving the rest with a bunch of worthless code on their hard drives.

In money laundering, the final step is the most important – when you turn the illicit funds into wealth that seems legitimate. This is called integration, and frequently involves converting the cash into tangible physical assets like property, investments, and gold. People can live in castles and drive fast cars, they can enjoy good wine and dress in expensive jewelry, but they can’t doing anything with a Bitcoin, except hope that somebody will pay them real money for it eventually. If that doesn’t happen, the Bitcoin is essentially worth nothing, just like some paper currencies of the past. So a Bitcoin bubble is real and not unlike previous bubbles – Bitcoin is only worth what people think it is worth, and has no other intrinsic value. Which is why the argument that Bitcoin will forever hold its value is flawed, and will likely be proved false when the people controlling the vast majority of Bitcoin decide to cash out and convert their wealth into real-world assets, leaving the rest with a bunch of worthless code on their hard drives.

So, to reiterate, buying Bitcoins is not a bad idea. Buying cryptocurrencies in general is not a bad idea. Buying Bitcoin now, at current prices, is a bad idea. It’s precisely this irrational fear of “missing the boat” that causes bubbles to form and then crash. Don’t. Invest if you want to, but don’t spend what you aren’t prepared to lose, and don’t expect to get rich buying Bitcoins at today’s prices. If you really must spend your money on something virtual, there are lots of other things out there, too.